Monitoring compliance to environmental laws and regulations can be costly and

time consuming for insurers, shipowners and regulators alike. Failure to comply

with legislation relating to the recycling of vessels, such as the European Waste

Shipment Regulations, UN Basel Convention, and local laws may lead to

severe consequences, including imprisonment of the parties involved, investigation

of the insurers, and heavy financial penalties. Above all, these cases will hit the media

powerfully, resulting in significant reputational consequences.

Solution - REACT Underwriting Tools

- Enhanced risk selection functionality across all insurance classes, including mobile and fixed assets

- Tailored risk scoring based on detailed analysis to support more intelligent and more efficient decision making

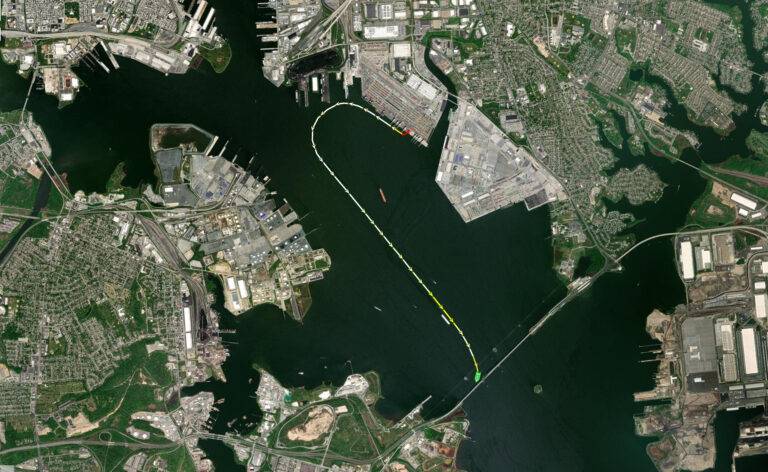

- Apply accurate rates and deductibles with deep asset and portfolio insights from real-time and historical analytics, including value, utilisation, safety, compliance, and claims’ history

- Global and competitive benchmarking, for a comprehensive comparing tool

- Ability to rapidly upload and amend portfolios to recalculate policy parameters at the click of a button

RESULT

- Using REACT generated insights and information, the client was able to justify increased premiums by providing detailed forensic analysis of utilisation reports, compliance, sanctions, deficiencies, and detentions.

- Global and competitive benchmarking were applied to examine and justify risk scores and pricing at an asset and portfolio level.

- The relationship was strengthened not only in terms of credibility and accuracy, using the insights and the expertise demonstrated but also by the adoption and application of new digital technology to differentiate

themselves in a very competitive marketplace.